Strategic Analysis of the Bangsar South Property Market: Trends, Yields, and 2026 Outlook

The transformation of Bangsar South—formerly known as Kampung Kerinchi—into a fully integrated Multimedia Super Corridor (MSC) status hub represents one of the most significant urban renewal success stories in the Klang Valley. Positioned strategically between Kuala Lumpur’s city centre and Petaling Jaya, Bangsar South property has evolved from a niche investment into a primary target for expatriates, multinational corporations, and local urban professionals.

As we approach 2026, the precinct faces a pivotal year influenced by federal infrastructure upgrades, shifting tenant demographics, and new fiscal policies introduced in the national budget. This article provides a data-driven outlook on Bangsar South condo investment, rental yields, and the lifestyle factors driving demand.

Market Overview: Bangsar South Property Price Trends

The residential landscape in Bangsar South is characterized by high-density, vertical living, offering a stark contrast to the low-rise, landed nature of its older neighbour, Bangsar. The market is dominated by serviced residences and condominiums designed to cater to the workforce occupying the adjacent Grade A office towers.

Current Transaction Performance

Recent transaction data indicates a resilient market for Bangsar South apartments for sale. For the period ending early 2025, the median transacted price for benchmark developments like South View stood at approximately RM 617,500, translating to a median price of RM 762 per square foot (psf). Notably, well-maintained units in this development have recorded transactions as high as RM 805 psf, reflecting a year-on-year appreciation of roughly 4.26%.

In the primary market, new launches are setting competitive benchmarks. Laurel Residence, a 42-storey development by UOA Group scheduled for completion in late 2025, lists suite apartments starting from RM 450,000, with larger units priced up to RM 899,300. This pricing strategy targets the "compact luxury" segment, appealing to investors seeking lower entry points compared to the RM 1 million+ threshold common in Mont’Kiara or KLCC.

The "Flight to Quality" in Commercial Real Estate

A critical driver for Bangsar South office to residential demand is the health of the commercial sector. The broader Kuala Lumpur office market is experiencing a "flight to quality," where tenants migrate to ESG-compliant, modern buildings. Bangsar South, part of the "KL Fringe" market, has benefited immensely from this trend.

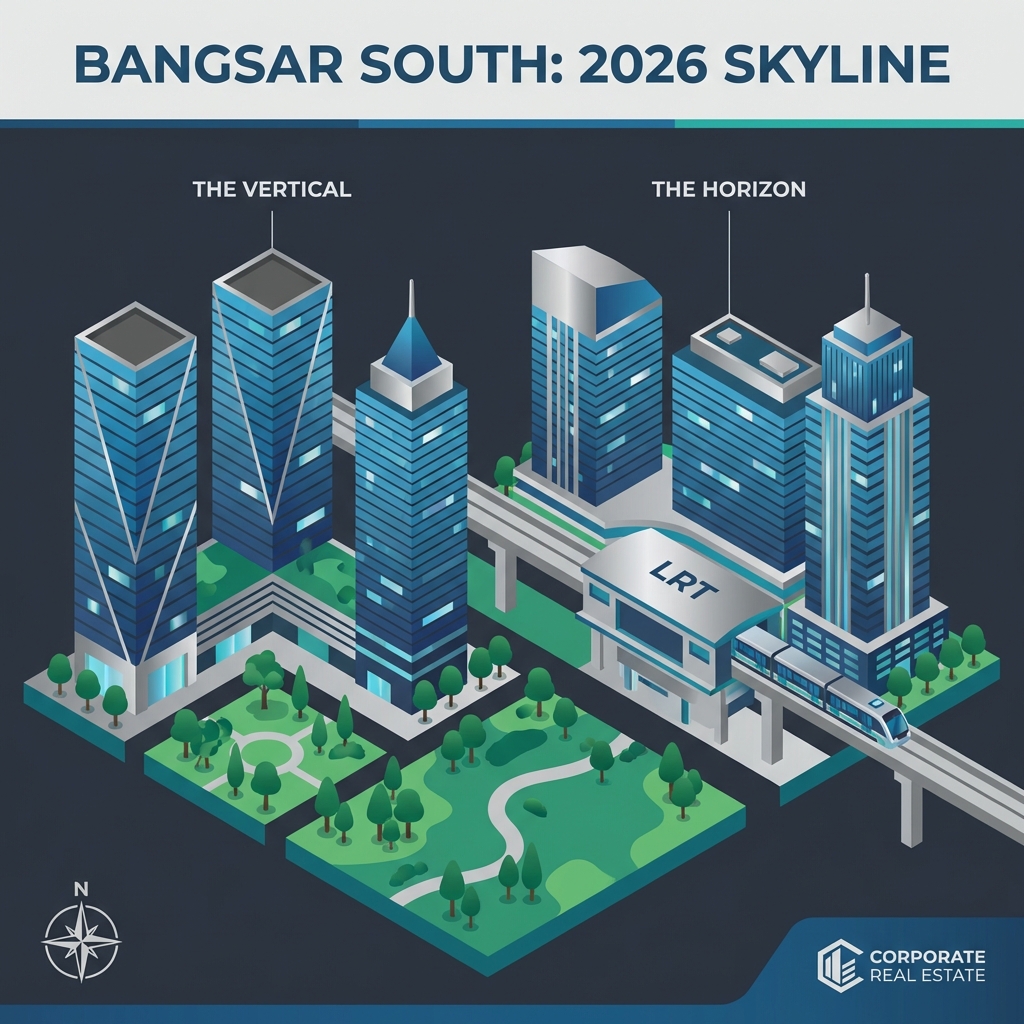

As of late 2025, office rents in the KL Fringe rose to an average of RM 5.83 psf, outperforming older precincts. High occupancy rates in MSC-status buildings, such as The Vertical and The Horizon, ensure a steady stream of white-collar professionals seeking nearby accommodation, thereby sustaining the rental ecosystem.

Rental Market Analysis: Yields and Demographics

For investors, the Bangsar South rental yield remains a compelling metric. The area serves as a "middle ground" between the exorbitant rents of KLCC and the suburban commute of Petaling Jaya.

Rental Yield Performance

Gross rental yields in Bangsar South typically range between 3% and 6%, depending on the unit size and furnishing.

- 1-Bedroom units: Monthly rentals generally range from RM 2,500 to RM 4,000. These units are highly liquid, catering to singles and digital nomads.

- 2 to 3-Bedroom units: Family-sized units command rentals between RM 3,500 and RM 6,000.

This performance is supported by the area’s connectivity. Properties within walking distance of the Universiti or Kerinchi LRT stations command a premium due to the convenience they offer to non-driving expatriates.

Bangsar South Expat Rental Demand

Bangsar South expat rental demand is distinct from other enclaves. While families often prefer the international school networks near Mont’Kiara or the landed homes of Bangsar, Bangsar South attracts younger expatriates and working professionals in the tech and finance sectors. The "walkability" of the precinct—where one can live, work, and dine without leaving the development—is a major draw for this demographic.

Lifestyle & Living: The Integrated Urban Experience

Living in Bangsar South offers a curated, modern lifestyle that differs significantly from older neighbourhoods.

Amenities and Connectivity

The township is anchored by lifestyle hubs such as The Sphere and Nexus, which provide grocery options (Aeon MaxValu, Jaya Grocer), wellness centres, and a diverse F&B scene ranging from casual cafes to rooftop dining.

- Healthcare: The precinct is a mini medical hub, hosting Life Care Diagnostic Medical Centre and located just minutes from Pantai Hospital Kuala Lumpur.

- Transport: It sits directly on the Federal Highway and is served by the Kelana Jaya LRT line, placing it 15 minutes from KL Sentral and Mid Valley.

Bangsar South vs Bangsar Property

Investors often weigh Bangsar South vs Bangsar property. The distinction is clear:

- Bangsar: Characterized by "old money," landed bungalows, and low-rise condos. Prices often exceed RM 1,000 psf, and the vibe is suburban and affluent.

- Bangsar South: Defined by high-rise integrated developments, leasehold tenures, and a fast-paced, corporate atmosphere. It offers a lower entry price and higher rental liquidity for smaller units.

Future Development and 2026 Outlook

The Bangsar South property outlook 2026 is heavily influenced by infrastructure catalysts and macroeconomic policy.

Infrastructure: The MRT3 Factor

The upcoming MRT3 Circle Line is a significant game-changer for the wider Pantai Dalam and Bangsar South area. The proposed Pantai Permai station will likely spur bangsar south future development, unlocking value in fringe areas like Pantai Dalam. Projects such as River Park, located near the proposed alignment, are positioning themselves as infrastructure plays, with analysts predicting capital appreciation as the rail network matures.

Budget 2026 Impact

The Malaysian government’s Budget 2026 introduces key shifts that investors must navigate:

- Stamp Duty Hike for Foreigners: The flat stamp duty rate for foreign buyers is set to increase from 4% to 8% starting in 2026. This may cool demand in the luxury segment but could encourage foreign investors to lock in purchases before the implementation date.

- Green Incentives: Properties with green certifications (GreenRE/GBI) are gaining traction, eligible for preferential mortgage rates (0.3%–0.5% lower) from major banks. Bangsar South’s newer MSC-status buildings are well-positioned to capitalize on this ESG shift.

Bangsar South Condo Investment Strategy

For 2026, the investment thesis revolves around "connectivity arbitrage." While central Bangsar South is mature, the periphery (Pantai Dalam/Kerinchi) offers lower entry prices (RM 650–RM 800 psf) with significant upside potential once the MRT3 creates a seamless loop connecting the area to Mont’Kiara and Ampang.

Data-Backed Insights: The 2026 Forecast

The trajectory for Bangsar South serviced residence units remains positive, albeit with a shift in buyer profile.

- Price Stability: Following the post-pandemic correction, prices have stabilized. The "compact luxury" trend is evident, with developers launching smaller units (under 900 sq ft) to keep absolute prices below RM 900,000.

- Rental Resilience: With the return-to-office mandates and the expansion of the digital economy (Budget 2026 allocates RM 5.9 billion for digital initiatives), demand for accommodation near tech hubs like Bangsar South is expected to remain robust.

- Competition: Investors must monitor supply from neighboring projects in Old Klang Road and Pantai Dalam, which offer lower price points (RM 500–RM 600 psf) but arguably less prestige.

In conclusion, Bangsar South in 2026 represents a mature, high-yield investment destination. While the days of rapid, speculative capital appreciation may have moderated, the precinct offers stability, superior connectivity, and a lifestyle ecosystem that continues to attract Malaysia’s growing professional class.

Frequently Asked Questions (FAQ)

Is Bangsar South a good place for property investment in 2025? Yes, particularly for investors seeking rental yields. The area consistently delivers yields of 4–5%, supported by a strong catchment of corporate tenants from local MSC offices. However, investors should be mindful of the dense supply pipeline.

How does the cost of living in Bangsar South compare to Bangsar? Rent in Bangsar South is generally more affordable for modern amenities compared to Bangsar. A 2-bedroom unit in Bangsar South averages RM 3,500–RM 4,000, whereas similar quality in Bangsar can exceed RM 5,000. However, food and grocery prices in Bangsar South’s lifestyle hubs (The Sphere/Nexus) are comparable to upscale KL standards.

What is the tenure of properties in Bangsar South? Most residential developments in Bangsar South, such as The Park Residences and South View, are leasehold. This is a key distinction from the predominantly freehold tenure found in the older Bangsar neighbourhood.

Will the MRT3 Circle Line affect Bangsar South property prices? Yes. The MRT3 is expected to enhance connectivity for the southern corridors of KL. Properties located within 800m of the proposed stations (such as Pantai Permai) typically experience capital appreciation of 15–25% as infrastructure nears completion.

Are there family-friendly amenities in Bangsar South? While Bangsar South is tech-centric, it features a 6-acre central park and is close to hiking trails at Bukit Gasing. For education, it relies on nearby neighbourhoods; schools like Alice Smith and Garden International School are a 15–25 minute drive away.

Related Resources

- Compare Neighborhoods: See how this tech hub stacks up against the suburbs in our analysis of the Petaling Jaya Property Market.

- Policy Updates: Understand how new tax laws affect you in our guide to Malaysia Budget 2026 Property Incentives.

- Infrastructure News: Explore connectivity upgrades in our detailed report on MRT3 Circle Line Impact on Property Values.

- Find Listings: Browse curated Bangsar South Listings here.